- Home

- Accounting

- Accounts Payable Outsourcing: Pros, Cons, & Best Practices

Accounts Payable Outsourcing: Pros, Cons, & Best Practices

Amr Fahmy

I use 8 years of content excellence experience to ensure everything you...

More about the authorFebruary 2, 2026

Accounting

11 mins

Table of Contents

Know your managed accounting options: AP outsourcing, In-house AP, AP Automation & Shared Services Centers.

The accounts payable department is responsible for managing any invoices or due payments for vendors and suppliers the business works with to provide material, products, services, or other goods. Besides managing the invoices and ensuring the payments are made promptly, the accounts payable process ensures a smooth relationship between the business and the vendors, so vendor relationship management is an essential side of this function.

Outsourcing accounts payable relies on a third party to manage this crucial accounting function. Accounts payable outsourcing can benefit the business in many ways, such as cutting down the costs of hiring an in-house team, increasing the efficiency of internal operations, removing the burden of managing an in-house team, and alleviating the risks of fraud and non-compliance with financial regulations.

When executives consider outsourcing accounts payable, they usually come across keywords such as in-house teams, AP automation, SaaS services, or shared services centers. The differences between these options are essential to note in this article to help businesses pick the right partner for them and their growth goals. In the following, we will discuss the benefits and cons of choosing to outsource AP compared to having an in-house AP department, AP automation, and the shared services center.

1- In-house Accounts Payable

In-house accounts payable is the traditional way of handling a business’s accounts payable and invoice-to-payment processes. It’s a team of resources that are hired and managed internally. Despite requiring complete management and retention of the department, it allows full control of all transactions and the overall financial performance of any cash-out.

2- Accounts Payable Automation (also known as AP Automation)

Businesses resort to automate accounts payable processes and transactions, especially accounts payable software, to ensure that payments of vendors are happening smoothly and automatically with the least number of errors and risks. This AP process is possible when subscribing to a SaaS solution, adopting a dedicated accounting software, or adopting an ERP system on-premises.

While an ERP system can include and automate many functions other than accounting, such as logistics, procurement, and human resources, to name a few, accounting software is specifically made to handle accounting tasks only, automating the functions of bookkeeping, general ledger, chart of accounts and accounts receivable and payable.

| Feature | Accounting ERP | Accounting SaaS |

| Deployment | On-premises/ Cloud | Cloud-based |

| Cost | Costly setup and maintenance fees | Subscription fees |

| Implementation | Complex | Easy |

| Maintenance | Requires in-house dedicated IT maintenance team | Operated entirely by the SaaS solution provider |

| Scalability | Can be challenging to scale up or down | Easy to scale up or down through upgrades and downgrades of packages |

| Security | Requires a robust IT security infrastructure setup | Managed and secured by the SaaS provider |

| Updates | Requires manual updates | Managed by the SaaS provider |

| Integration | Can be challenging to integrate with other systems | Easy to integrate with other systems if it is includes with an API integration option |

3- Accounts Payable Shared Services Center

A shared services center (SSC) is a centralized and consolidated business unit that provides services for multiple units within the same organization and/or numerous entities simultaneously. Accounts Payable SSC is a unit that handles all accounts payable transactions for more than one business unit within the organization, and sometimes, they control the invoice-to-payment processes for several entities.

Accounts payable outsourcing and accounts payable SSC are usually seen as similar options offering almost identical models to businesses, but there are also some notable differences to clarify here.

| Feature | Shared Services Centers (SSC) | Account Payable Outsourcing |

| Ownership | Internal | External |

| Staff | Employees of the organization | Outsourced expert accountants provided by the partner |

| Location | On-site or off-site | Nearshore/ offshore locations |

| Control | More control over operations | Less control over operations/Managed Services Model |

| Flexibility | Less ability to adapt to changing needs | More flexibility to adapt to changing needs (e.g., seasonal demand, layoffs, or scaling up) |

| Cost | More expensive to set up and operate | Helps reduce the costs of hiring and managing a team internally |

| Expertise | Less ability to scale or grow expertise with less exposure to experience outside the organization | Diverse set of expertise with the ability to leverage knowledge-backed solutions from the outsourcing provider |

4- Accounts Payable Outsourcing

Accounts payable outsourcing enables businesses to rely on an outsourcing provider’s expertise to handle any volume of day-to-day transactions related to invoicing, payment processing, installment management, vendor relations management, and communication. Businesses usually assign these tasks to an outsourcing accounts payable team to achieve the utmost accuracy of the invoices and the delivery of payments, leading to smooth and steady interactions with the suppliers and vendors. Let’s share more information to help you find out if you should offshore your AP.

Why you should outsource your accounts payable

This quick comparison will help you understand the benefits of outsourcing.

| Characteristic | In-House AP | Outsourced Accounts Payable | Shared Services Center | AP Automation |

| Capacity | Tight scaling options / limited capacity | High flexibility to scale up and down / tailored capacity according to need and demand | Handles transactions of diverse business units and sometimes different entities | ERP: Hard to scale / high automation capacity Accounting SaaS: Easy to scale / lower automation capacity |

| Efficiency | Less efficiency with little room for acquaintance with technology updates | Higher levels of efficiency can be achieved as operations shift to focus on core tasks | Medium level of efficiency is achieved through standardized processes and the centralization of the unit | High level of efficiency through rapid automation and high visibility on accounts payable transactional data and results |

| Control | Complete control by the organization | Full control by the outsourcing partner (managed by SLAs) | Shared control between the SSC unit and the organization | ERP: Complete control by the organization Accounting SaaS: Shared control with the SaaS provider |

| Operations | Weighs on the operations and requires close management | Saves the management house and frees operations from the operational burden of running the AP tasks | Shared responsibility and operational efforts between the organization and the SSC unit leaders | ERP: requires internal IT efforts to maintain operations Accounting SaaS: relies on the SaaS provider’s capabilities |

| Cost | High costs of hiring, retention, benefits & space | Significant cost savings compared to in-house AP and SSC & installing in-house ERP | High costs of hiring, retention, benefits & space (less compared to in-house AP) | ERP: High cost (setup & maintenance) Accounting SaaS: Subscription fees |

When should you consider an AP outsourcing provider?

It is great for businesses to look inside their organization and evaluate the number of challenges their internal teams face before switching to external support. The following are some of the challenges companies might face; therefore, this list can be considered a checklist for switching to an outsourced accounting provider:

- Increased transaction processing, reducing focus on core activities and offering financial insights about the operational performance.

- Business growth leading to growing partnerships and an increased base of vendors and suppliers that pressure the accounts payable team with no clear hiring plans.

- Increased costs of hiring calibers (salaries, compensation packages, training & development) in key markets, a foreseen shortage of accounting and finance professionals in the USA, and the increased number of retiring and change-of-career professionals.

- Weak service levels and lack of standardized processes resulting in overwhelmed and slowed operational tempo.

- Limited access to enabling technology and advanced accounting tools for decision-making insights and reporting and a lack of understanding of the changing competitive landscape.

- Organizational mergers and acquisitions (according to Deloitte).

What are the best practices to hire an accounts payable outsourcing provider?

There are many providers of outsourced accounts payable out there, and they might look like they are offering the same thing at first glance on their services and benefits. However, some practices can be followed to ensure that businesses partner with the proper payable service provider.

Consider the following when evaluating the accounts payable outsourcing provider:

- Ability of the provider to adapt to the business size and the operations.

- Ability to size up and down with flexibility to seasonal demand and changing needs.

- Ability to operate from different locations across the globe.

- Provider’s substantial clientele base and track record of success with similar accounts.

- Access to advanced technology, insights tools, and reporting.

- Provider’s ability to promote a clear and solid brand value proposition to attract strong talent.

- Provider’s ability to establish a functional work environment for the outsourced calibers.

On the business side, you must also consider the following best practices before partnering with any accounts payable outsourcing provider:

- Assign clear and solid vision goals for the outsourced accounts payable team.

- Define a clear service delivery model and agreement.

- Study the market of the accounts payable outsourcing partner and their locations.

- Study the cost and savings plan in light of the packages of the accounts payable outsourcing partner.

- Consider any implementation barriers on both sides.

Challenges to the success of an outsourced accounts payable partner

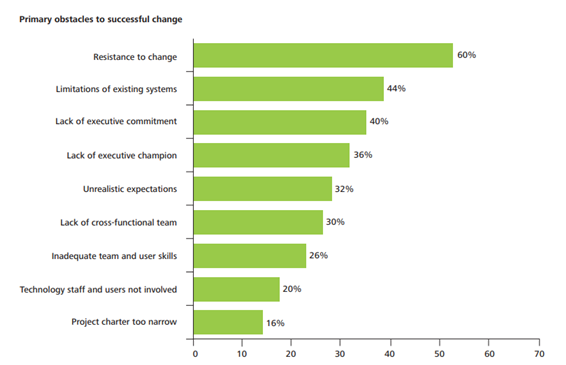

It is worth mentioning that the challenges to achieving a successful outcome from the outsourced accounting partner can be found within the existing processes and systems of the organization, resistance to change, and setting unrealistic expectations, among others.

What is accounts payable outsourcing?

Accounts payable outsourcing means hiring an external partner to do all related accounts payable tasks and activities, including invoice processing and payment, maintaining vendor relationships and sound AP records, and compliance with tax rules and regulations.

How do you find a good accounts payable outsourcing partner?

In order to find the right accounts payable outsourcing partner, you should understand their ability to match the size of your business and its operations and ensure they can scale smoothly as you achieve growth. The accounts payable outsourcing partner should also have robust expertise working with a substantial client base with a proven track record of success in your market. The provider’s ability to operate from different locations is a huge added value to cater to the needs of your operations and the varying demand in different sites and time zones.

What are the most common cons of outsourcing accounts payable, and how to avoid them?

While outsourcing the accounts payable function offers numerous benefits, it’s not without challenges. Common drawbacks include:

Loss of Control: Handing over the process to a third-party provider may reduce visibility into day-to-day operations.

How to Avoid: Establish clear service-level agreements (SLAs) and demand regular reporting to maintain oversight.

Communication Barriers: Offsite teams or time zone differences can delay issue resolution.

How to Avoid: Partner with an outsourcing firm that offers overlapping working hours and uses collaborative tools.

Dependency on Manual Processes: Some providers rely on manual processes, increasing error risks.

How to Avoid: Verify the provider’s use of automated workflows and integration with your accounting system.

Hidden Costs: Unexpected fees for scaling or added services can arise.

How to Avoid: Negotiate transparent pricing models upfront and align them with your business processes.

What are the pros and cons of choosing accounts payable outsourcing companies over AP automation software?

Deciding between an AP service provider and AP automation software depends on your business needs:

Pros of outsourcing accounts payable:

Benefits of outsourcing accounts payable include access to skilled professionals who manage complex tasks like vendor disputes or compliance, reducing the burden on internal teams.

Flexibility to scale operations without investing in new technology or training.

Ideal for businesses lacking in-house expertise or struggling with outdated accounting service workflows.

Cons of accounts payable outsourcing:

Less direct control compared to owning an automated accounts payable solution, unless you work with a transparent third-party accounts payable team.

Potential delays in communication compared to real-time software updates, unless you work with professional outsourcing solutions providers.

Many outsourcing providers don’t offer the same level of professionalism we do. So when you outsource your company’s accounts payable to them, you’ll get more cons than benefits.

Pros of AP Automation:

Accounts payable automation software streamlines business processes with minimal human intervention, reducing errors.

Integrates seamlessly with existing ERPs or accounting systems for end-to-end visibility.

Cons of AP Automation:

High upfront costs and training requirements.

Limited adaptability for unique or evolving workflows compared to human-driven outsourcing firms.

I use 8 years of content excellence experience to ensure everything you read is accurate, backed by real industry data and insights.