- Home

- Accounting

- Outsourced Accounting: All You Need to Know in 2025

Outsourced Accounting: All You Need to Know in 2025

Table of Contents

Call center or customer experience outsourcing might be considered the most commonly outsourced function in a business. Still, recently outsourced accounting has taken second place as the most outsourced function, following Information Technology outsourcing, preceding outsourced BPO financial services & BPO accounting, BPO customer service or client services, or call center outsourcing. As of 2023, 44% of companies globally resort to outsourced accounting and finance services, making them one of the most sought-after business functions as companies focus on their core functions or find ways to save costs and time.

In this blog, we will walk you through everything you need to know about outsourced accounting services and how partnering with a reliable outsourced accounting provider can help your organization cut costs significantly, improve operational tempo, and elevate its talents’ contribution to success.

What is Outsourced Accounting Services and Finance?

Accounting and finance are crucial functions for the success of any business. Finance and accounting services together form the backbone for any business’s key financial decisions. They can be used to develop data-driven decisions that help the business progress toward its goals and achieve value for its owners or shareholders. The more these functions deliver accurate and error-free results within their organizations, the more they provide solid strategies, better decision-making mechanisms, and a more defined direction toward achieving a better return on investments, consequently leading to the company gaining support and a competitive advantage in their industry.

They are becoming one of the most outsourced services sought after. BPO Outsourced accounting services includes relying on third-party entities with prominent calibers and capabilities that will take over some, if not all, the accounting functions within the company either on a project basis or according to a specific agreed-upon duration. Amongst the services, we see auditing as a key service that is usually assigned to a third party, besides financial reporting, planning, and budgeting, accounts payable and receivable services, taxation, bookkeeping, and payroll processing.

Outsourced accounting services and finance services here become a contractual relationship between the business, its stakeholders and the provider of the professional calibers that are undertaking the outsourced functions. This contractual relationship governs the mutual growth and exchanged benefits for both parties. For example, a business should ensure the professionals are within the right cultural and work environment that enables them to perform highly in their tasks and excel at them. It also pays off to check what training those calibers receive within the outsourced accounting services providers’ company.

They cover many functions crucial to the business’s performance in the market. While accounting focuses on bookkeeping, recording of financial transactions, and reporting on them. Therefore, it has a wider view on the financial situation of the business, handling its financial reporting, planning, budgeting, financial risks, cash flow, and financial analytics and reporting.

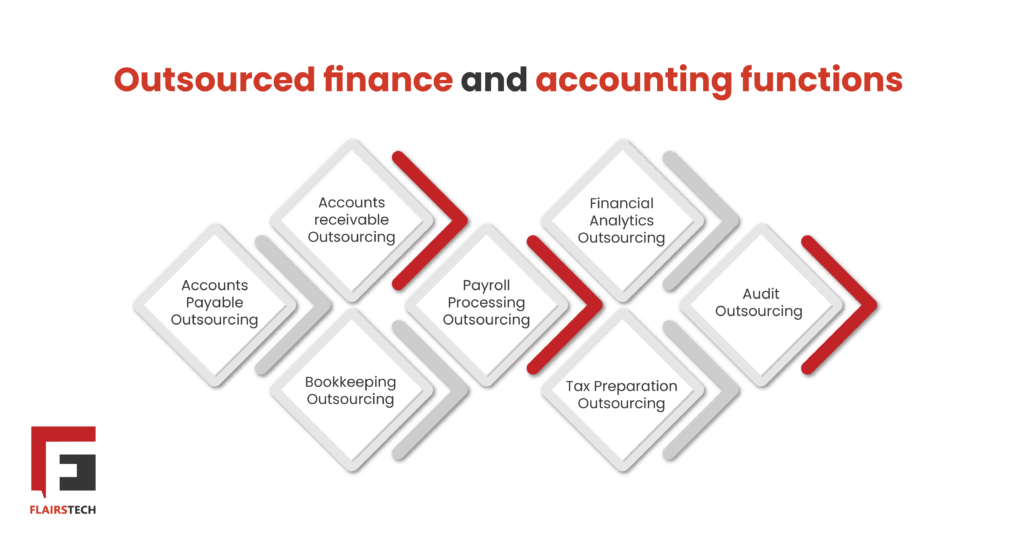

Outsourced Accounting and Finance Functions

Accounting and finance cover many functions crucial to the business’s performance in the market. While accounting focuses on bookkeeping, recording of financial transactions, and reporting on them. Therefore, finance has a wider view on the financial situation of the business, handling its financial planning, budgeting, financial risks, cash flow, and financial analytics and reporting. In the following section, we will go into more detail about the most outsourced functions of accounting and finance:

Accounts Payable Outsourcing

Accounts payable are the amounts the company owes to the different suppliers and vendors they are dealing with to purchase goods, products, and services for various purposes. This includes dealing with a large volume of day-to-day transactions related to invoicing, payment processing, installments management, as well as vendor relations management and communication. Businesses usually assign these daunting tasks to an external accounts payable team focused only on ensuring the accuracy of the invoices and the delivery of payments, leading to smooth and steady interactions with the suppliers and vendors.

Accounts Receivable Outsourcing

Accounts receivable are the opposite of accounts payable as they represent the amounts the company needs to collect from its customers for the products, services, and goods they provide. The department is a crucial accounting function. It regulates the relationship between the customers and the company and ensures that the company has sound records of its invoices, payments, and overall collections processes. The accuracy of these processes leads to improved cash flow and customer relationships. With receivable, businesses gain access to expert professionals in invoice management as well as better reporting on inflows of cash affecting many business growth areas and highlighting different improvement areas related to sales revenues, investment income, and sales of assets, among others.

Payroll Processing Outsourcing:

Payroll processing includes many functions related to the financial aspects of the company’s workforce, such as salaries and wages, issuing checks and deposits, handling 401Ks, etc. Assigning payroll processing tasks to an outsourced accounting services provider helps take off the burden of managing all the employees’ financial-related processes from the company, ensuring that the employees’ financials are taken care of as well as other administrative benefits, including health and social insurance, and retirement plans execution, as well as handling all time-sheet related matters, making sure employees are compensated for their over-time.

Bookkeeping Outsourcing:

Bookkeeping is the function that keeps all accounting transaction records up to date and keeps track of the overall accounting performance of the company. This function also includes ensuring the accuracy of all the company’s financial statements as well as providing the decision-makers easy access to them. Moreover, bookkeeping is directly related to all the company’s financial data, which is the most valuable factor in the company’s planning and forecasting. As bookkeeping consumes a large part of the capacity of the accounting unit, it can create a bottleneck that hinders expediting the pace of the team and the speed at which they process transactions.

Financial Analytics Outsourcing

Financial analysis helps businesses evaluate their financial position by looking into the budgets, outcomes of projects, and overall performance of the organization in terms of cash flow and investment opportunities. There are two main types of financial analysis: fundamental and technical.

While fundamental financial analysis relies on ratios based on the company’s financial data, such as financial statements, economic data, and industry trends, technical financial analysis investigates the status of the company’s securities. In simpler words, an analyst looking to analyze financial data technically aggregates and analyzes historical data on the prices of stocks and bonds, and even checks currency trends to identify any patterns. On the other hand, fundamental financial analysis takes into consideration the organization’s health and macroeconomic conditions surrounding the business, contrary to the technical analysis that disregards any factors that might affect the securities’ value.

As such a critical role, financial analysis plays a part in the success of any organization. Therefore, it has to rely on advanced data processing tools and professionals with the needed knowledge of these tools and unique analytical skills. Outsourcing financial needs and analytics not only provides access to such talent pools but also provides the needed personnel trained on the latest data analytics and visualization tools such as business intelligence tools, data mining and cleaning tools, cloud computing, all the way to talents that can use machine learning, AI and DLT technology (the technology of decentralized/democratized data storage behind the blockchain) to store and sort data in the most efficient, accessible and transparent manner possible.

Tax Preparation Outsourcing

Tax preparation is the process where the accounting and finance unit takes care of all taxation-related matters, such as collecting and filing tax documents, ensuring compliance with taxation, staying on top of taxation updates and regulations to maintain refreshed credits and deductions, and doing income calculations.

In businesses with heavy volumes of transactions, multiple income sources, and diverse asset ownership, a solid and relatively big tax preparation team needs to process all required tax documents and ensure compliance support and up-to-date knowledge of regulatory changes. Thus, outsourcing tax preparation seems a convenient option for many businesses nowadays, especially when tax preparation becomes costly in terms of hiring in-house full-time teams or with the increased workload of tax preparation that is both effort and time-consuming.

Audit Outsourcing

Auditing is the governing function that ties all other accounting and finance efforts together, as auditors ensure all records, statements, results, and financial processes are accurate and verified. Auditing also confirms the compliance of the company’s financial performance with the standards. If there are any gaps in the financial documentation and records that have been presented, then the auditing reports can highlight them and make recommendations for the improvement of the financial situation of the organization.

As the current economic status worldwide is pressuring businesses to become more efficient and flexible to mitigate risks, relying on an outsourcing partner to provide auditing services can be the solution to help organizations achieve that. Furthermore, the role of auditing is further expanding now to cover and support a wide array of ever-evolving topics and areas such as talent management, cybersecurity, regulatory compliance, risk management, and fraud detection and prevention. Outsourced accounting providers offer a wealth of talents that are constantly trained and up to date in these areas and topics, which enables businesses to elevate their auditing capabilities in the most cost-effective ways.

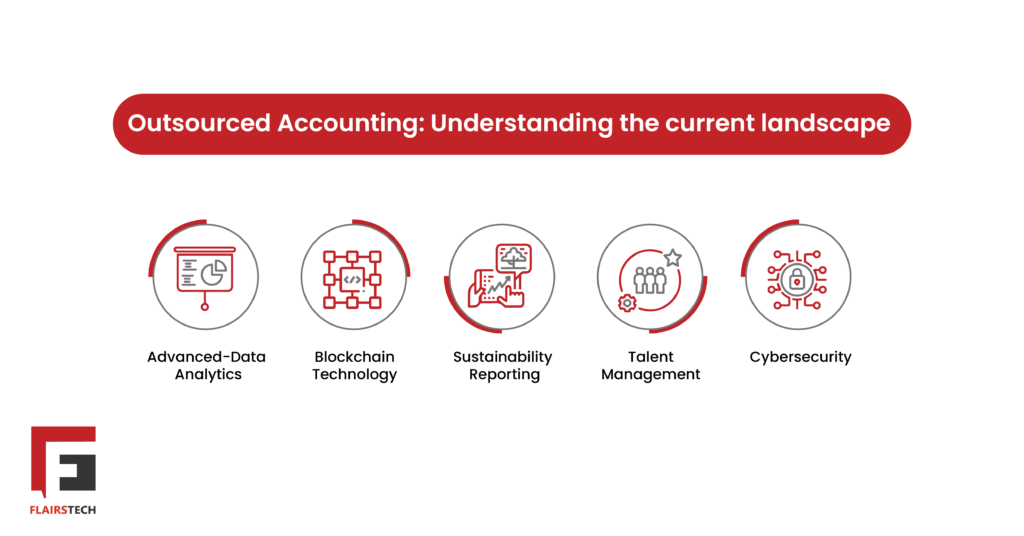

Understanding the Accounting Support Landscape

Here’s an overview of the most recent trends that affected the field of outsourced accounting and finance:

Main Trends Highlighted in the Accounting Department

1- Advanced Data Analytics

Data has become one of the most important assets for organizations, and companies that manage to make the most out of their data, usually get the most out of their planning, conduct better forecasting, and even mitigate risks better. Accounting has been one of the fields that adopted data analytics heavily since accounting departments have had exclusive access to the most significant and most valuable organizational data assets.

Around 62% of Chief Financial Officers see there is a growing demand for accounting departments to become more insightful. In comparison, 53% of them have concerns about the internal accounting departments being more reactive than proactive due to the workloads thrown on their shoulders (according to recent research conducted by Accenture). The study elaborates that internal accounting and finance teams are short on time which is mainly involved in managing data only, as this takes up to 85% of their work, leaving them with just 15% of their time doing analysis and turning that data into valuable data-driven insights.

Nowadays, it is increasingly popular for organizations to resort to outsourced accounting providers with calibers that are highly trained in the usage of multiple tech stacks relevant to data analytics. This helps organizations understand their operations better and find new opportunities for continuous improvement of their processes, controls and overall performance as well as identifying and managing risks. Furthermore, outsourced accounting providers save on the cost of in-house acquisition of advanced data analytics tools and infrastructure, giving organizations a cost-effective opportunity to utilize data.

Due to the need for more data analytics tools that are advanced enough to serve multiple purposes, we saw an influx in software and data analytics tools development in recent years. Now, accounting units could use one or more of the following tools to utilize their data fully:

- Business Intelligence Tools (BI Tools): These tools help collect, sort, clean, and analyze the data to produce insightfully and visually better information for decision-making.

- Proprietary Tools: These are tools that are owned exclusively by a single organization internally, and they are usually coupled with the organization’s product, sold along with their service. These tools help with data extraction and analysis based on the interactions with the customers and users of the product or the service the organization is selling.

- Finally, there is an increased interest in adopting programming languages and codes to analyze huge data sets. R and Python have recently been used to produce in-depth and reliable statistical analysis of organizational data. Other programming languages such as Java, MATLAB, and SQL are being used as well, since they provide diverse frameworks for the extraction of data from dense databases, as well as tools for data visualization and statistical modeling.

2- Blockchain Technology

Entrusting outsourced accounting providers with essential financial duties and data analytics has required those providers to resort to more advanced data sharing and storage methods. Distributed Ledger Technology (DLT) has witnessed a spike in interest in recent years. As More accounting professionals, CPAs, and outsourced accounting providers are relying on these decentralized independent data storage units for the synchronization of financial transactions that are distributed as blocks, which increases the transparency of financial reporting, enhances the process of backing data up, and improves data accessibility and sharing with relevant stakeholders.

3- Sustainability Reporting

Sustainability reporting or sustainability accounting reporting takes into account the role the organization plays in social responsibility and abiding by the shared societal values in their different projects, products, or services. Moreover, sustainability reporting is the basis for any organizational communication of their ESGs, or in other words, how companies are delivering on their environmental, social, and governance goals.

As more organizations become increasingly reliant on outsourced accounting providers to provide consulting talents in this extremely niche area of reporting expertise, these providers have contributed massively to the organizations’ brand reputation and achieved a competitive advantage in the market. These contributions’ impact has even extended to powering influential green marketing campaigns in key markets. Overall, sustainability reporting contributes to better management of the organizational exposure and influence on the environmental surroundings. Hence, it helps with providing planning and opportunities to reduce the negative impact on the communities they operate in.

4- Talent Management

Organizations are becoming more attentive to the qualifications of the talent pools they access through outsourced accounting partners. As the role of accounting is constantly growing to cover more areas beyond data entry and data consolidation, the expectations of hiring more well-rounded professionals are getting higher every day. This has thinned the line between the outsourced accounting and finance services and talent-as-a-service model to the extent that outsourced accounting providers are now more into providing niche industry-specific calibers that can take over the entire function of finance and accounting within any given organization of any size and in different domains.

5- Cybersecurity

According to recent research conducted in 2022 by Deloitte: “Cybersecurity presents a challenge, and executives are willing to rely on third parties to deliver.” moreover, the report adds that 81% of executives reported they support their cybersecurity function with a third-party delivery model. Cybersecurity has also been at the intersection with accounting and finance. Outsourced accounting teams are expected to be well aware of the best practices of data protection as they mainly deal with critical and sensitive organizational data and are in charge of the analytics and insights shared for decision-making purposes. Cybersecurity and accounting also share the same goal of risk management, especially risks related to data storage and accessibility.

As we witness more progress towards the accounting function’s involvement in such key topics, outsourced accounting providers have been gearing towards leveling up their cybersecurity capabilities. Outsourced accounting providers now ensure that their pool of professionals is highly knowledgeable in areas such as data encryption, accessibility controls, network security, cloud computing, advanced data processing and analytics software. Additionally, outsourced accounting providers are becoming more attentive in providing the right onboarding programs for their professionals to increase their awareness of the different organizational models they will be integrated with in order to prevent data leakage or the breach of any regulations.

How to Work with an Outsourced Accounting Team

1- “Partner” with your outsourced accounting provider

Your provider will be an extension of your organization, and the stronger your partnership is, the better your communication will be optimized. Outsourcing businesses do not only take care of the technical training and management of the outsourced talents working with your organization, but they also bridge any gaps between the values of the team and the organization, which expedites the positive outcome from the outsourced units.

Additionally, accounting teams handle the organization’s most sensitive data, critical functions, and analysis. Establishing close communication with the provider will ensure their understanding of the internal organizational handbook of regulations to deal with such data, leading to tightened information security and data protection.

2- Analyze your organizational needs

Accounting outsourced solutions and finance functions might not work for all organizations. The decision to rely on external accounting partners depends on an organization’s operational needs and its aspirations to expand its capacity steadily. Organizations have to evaluate the status of their internal accounting and finance teams to understand their needs and weaknesses. This will lead to better judgment on the amount of cost and effort invested in the unit and establish a better view to compare this situation with the others where the organization decides to hire a team. Furthermore, pinpointing bottlenecks in the performance will highlight which functions that can be outsourced to a third party and which can be performed internally.

3- Ensure the clarity of SLAs

Establishing an explicit service level agreement and discussing this early on before the kick-off of the services is one of the key elements of the success of the partnership with a provider. SLAs act as the contract for an organization’s expectations needs’ fulfillment, scope of services, and the mechanism of the delivery of these services as well as the metrics that will determine the performance efficiency.

4- Consider the technology stack

Technologies and tools that are used by the outsourced accounting solutions team should also be evaluated according to the needs of the business and its internal accounting team and what the business is looking to achieve. For example, if there is an issue with organizing data and managing it in the best way for better accessibility and retrieval, then picking a provider that excels in bookkeeping is crucial. This provider should present the right tools and internal processes for transactional bookkeeping, or else they won’t fit the organization’s needs. The same applies to other functions, especially financial management analytics, which requires looking for teams that utilize the most advanced data analytics and visualization software, such as Business Intelligence tools.

Work with FlairsTech

We, at FlairsTech, developed our own processes and tools that include different approaches to accounting and finance in a myriad of industries and for various purposes. Our unit partners with businesses in their journey to put together the best teams that offer the best comprehensive outsourced accounting services customized for the operational model of each organization we deal with.

To ensure that businesses get the best outsourced accounting services, we ensure the quality and security of all our transactions. FlairsTech ISO-certified (ISO 27001) in information security management system (ISMS) ensures all data and transactions are secure, complaint and updated with the new data protection and privacy regulations. Furthermore, FlairsTech has obtained the ISO 9001:2015 certification for Quality Management System (QMS), which ensures the delivery of quality services that will give ongoing support the achievement of operational excellence in any organization.

Frequently Asked Questions

1. What is outsourced accounting processes?

Outsourced accounting solutions includes relying on third-party entities with prominent accounting and finance calibers that will take over some, if not all, of the accounting solutions functions within your company either on a project-basis or based on a certain agreed-upon duration. It also helps streamline financial reporting processes and ensures compliance with regulations.

Amongst the outsourced accounting services, we see auditing as a key service that is usually assigned to third parties besides financial management, strategic planning, and budgeting, accounts payables and receivables, taxation, bookkeeping, and payroll.

2. Why do you need to outsource accounting services?

Businesses that resort to outsourced accounting and finance services are looking to save costs in the first place. Still, these providers also look for partners to unburden core operations from such transactional processes and achieve financial compliance simultaneously.

Furthermore, organizations usually hire plug-and-play teams with the needed professional acumen to lead the financial operations with the least amount of internal training or onboarding.

3. What is an outsourced accounting services team?

Accounting and finance cover many functions that are crucial to the business’s performance. Unlike an in house accounting team, outsourced accounting firms cover many areas, such as bookkeeping, recording financial transactions, and reporting on them. In contrast, outsourced finance handles financial planning, budgeting, mitigating financial risks, cash flow management, financial analytics, and financial reporting.

4. What are the benefits of outsourced accounting services?

The benefits of outsourced accounting vary between cost reduction, operations improvement, accessing niche talent pool, and elevating the financial tech stack of the businesses.

Providers usually resort to outsourced accounting professionals to relieve the burden of managing accounting transactions internally, focusing on more core operational functions.

5. How does outsourced accounting contribute to operational efficiency?

Outsourced accounting streamlines financial tasks by using expert professional guidance from experienced professionals and automated tools, reducing the need for in-house management of time-consuming processes like bookkeeping, payroll, and reporting. This allows businesses to operate more efficiently, cut costs, and focus on core activities that drive growth.

6. Can outsourced accounting help increase productivity in my business?

Yes, outsourced accounting supports and frees up your internal team from time-consuming financial tasks like bookkeeping, payroll, and reporting. By shifting these responsibilities to accounting experts, your entire team can focus on strategic activities and actionable data, ultimately helping to increase productivity across your organization.

7. What role does outsourced accounting play in strategic oversight?

Outsourced accounting helps ensure your accounting needs are handled accurately and efficiently, giving you access to timely financial insights. This clarity supports stronger strategic oversight by allowing you to focus on high-level planning, informed decision-making, and long-term business goals.

8. What is back office accounting, and why is it important to outsource it?

Back office accounting covers routine but essential tasks like bookkeeping, payroll, and accounts payable/receivable. Outsourcing these functions ensures your accounting is aligned with your business needs while reducing the burden on internal staff. This allows your team to focus on higher-value activities, improving efficiency without sacrificing accuracy or control.

I use 8 years of content excellence experience to ensure everything you read is accurate, backed by real industry data and insights.