- Home

- Accounting

- BPO Accounting & BPO Financial Services: Evaluating Business Needs for Better Outsourcing Decision-Making

BPO Accounting & BPO Financial Services: Evaluating Business Needs for Better Outsourcing Decision-Making

Table of Contents

Accounting is one of the key contributors to the functional operations of any business. When accounting functions and transactions are sound, they give the business better control of critical financial resources such as assets, liabilities, income, cash flow, and monitoring expenditures. This, in turn, enables better management decisions and an enhanced strategic decision-making process. Furthermore, accurate accounting outsourcing contributes to visionary planning and solid budgeting of ongoing and future projects by providing forecasting insights about the business cash flow status and the allocation of financial resources in the right directions or channels, ensuring optimum return on investment. Accounting reports also provide insights into the overall organizational performance to evaluate the strengths and identify improvement areas.

Market Challenges

“The Bureau of Labor Statistics reports that job openings for accountants and auditors are projected to grow by 6 percent from 2021 to 2031—about 136,400 openings yearly. Many of those openings will likely result from workers retiring or transferring to different occupations, the BLS says.”

The accounting and finance field faces many challenges that hinder the progress and expansion of this function within the organizations. Among these challenges is the reported shortage of accounting and finance professionals in the USA and the increased number of retiring and change-of-career professionals. Additionally, the global economy is rapidly growing and evolving at an unprecedented pace with rising global economic crises; this adds pressure on organizations to perform better and adapt quicker, which requires highly performing and expansive accounting and finance teams.

The USA has an evolving regulatory environment, and with new regulations and compliance rules getting updated more often, organizations are pressured to adapt to these regulatory changes. Accounting departments are at the center of this as they face increased reporting requirements besides ensuring compliance with many regulatory systems such as the GAAP, SOX, and other industry-related regulations.

Resorting to BPO accounting services & BPO financial services providers is one of the most effective options to help remove such operational burdens and enable organizations to overcome challenges and grow steadily.

Shifting to Outsourced Accounting

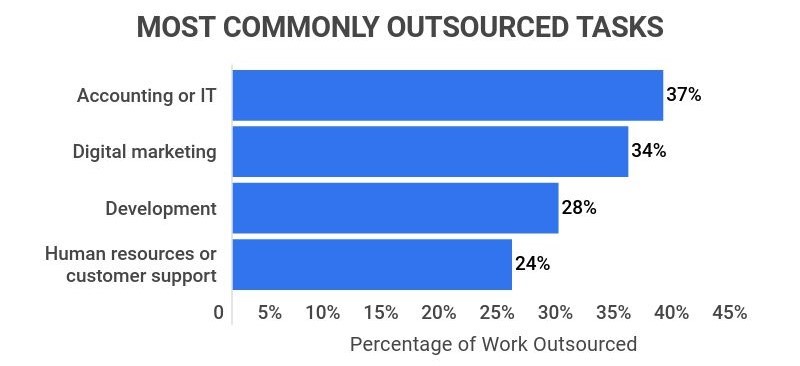

Outsourced accounting is the practice of relying on a BPO accounting & BPO financial services provider’s services, solutions, tools, and calibers to take over some, if not the entire accounting functions. The outsourced services market has seen a spike with the increased inclination of more companies to outsource more functions for better efficiency. Sources have reported that 66% of businesses in the United States outsource at least one department. Information Technology and Accounting top the list of industries often outsourced by organizations regardless of size and specialty.

What to consider when shifting to outsourced accounting?

Before shifting to hiring an outsourced accounting department, the business executives should thoroughly evaluate their current needs and the status of the internal accounting operations and processes. It is worth considering the following questions that help in assessing the benefits of outsourced accounting solutions and partnering with the best outsourced accounting services provider:

- How is the current accounting unit performing? What are their KPIs, and how are they performing within the company?

- What are the gaps in the performance of the internal accounting team, and what are the organization’s needs from this department?

- What are the goals set for outsourcing accounting?

- What is the approach to onboarding an outsourced accounting department to your organization’s processes and internal controls?

- What regulations and compliance rules are you following and should be handled by the outsourced accounting department?

- What functions will the outsourced accounting team handle?

- How can the outsourced accounting department be of added value to your operational performance?

- What systems, software, and tools are you dependent on and need a certain level of proficiency from the outsourced accounting team?

- What is the cost of hiring an outsourced accounting department?

- What is the level of access and control the outsourced accounting department has on financial data and reports? Are there any limitations or restrictions?

- What are the methods and channels of communication? How do you want to set the SLA?

- What are the business’s scalability and flexibility requirements that the outsourced accounting provider should meet?

The benefits of outsourcing accounting services

1- Cost-effectiveness

Outsourcing accounting achieves 40-70% saved costs for an organization compared to hiring an internal accounting team. Moreover, about 59% of businesses report cost as the biggest reason for outsourcing, making cost reduction a massive plus in the decision-making process of hiring an outsourced accounting team.

2- On-demand Expertise

Relying on an outsourced accounting services provider with a substantial pool of experts and professionals helps the business to tailor a convenient outsourced accounting team with roles ranging from bookkeepers to seasoned CFOs.

3- Flexible Scalability

External outsourced accounting teams have more flexibility to scale up or down, and some providers offer diverse engagement models as well as payment options for active resources.

4- Focus on core functions

External outsourced accounting teams offer managed services that reduce the operational burden, so you can focus your efforts on more core functions and competencies.

5- AI-enabled Services

Some outsourced accounting providers are now leveraging AI’s power to augment their teams’ capabilities, and increase the productivity of their resources and the accuracy of their reporting.

What are the functions provided by outsourced accounting providers?

Accounting encompasses many functions outsourced accounting providers can offer, from accounts payable outsourcing to financial integrations and analysis. BPO accounting and BPO finance services providers can tailor their solutions to meet the requirements and setup set by the business for the aspired outsourced accounting department. The following are standard accounting functions that can be outsourced:

Accounts Payable

- Installments Management

- Invoicing

- Payment Processing

- Vendors & Suppliers Management

- Order & Inventory Management

Accounts Receivable

- Collections Management

- Customers’ Invoices Management

- Customer Relations Management

Financial Analytics

- Data collection, cleaning & analysis

- Financial reporting & modeling

- Financial Optimization

Financial Integrations

- ERP Migration and Implementation

- Financial Systems Integrations

Auditing

- Internal & External Auditing

- Compliance Auditing

- Risk Assessment & Controls Testing

- Audit Planning & Reporting

Tax Preparation

- Tax Calculation & Processing

- Tax return filing

- Tax Compliance

Payroll Processing

- Payroll Management

- Compensation & Benefits Management

Bookkeeping

- Transactions’ Recording

- Reconciling Accounts

Reports Preparation

FAQs

Why hire outsourced accounting teams?

Besides the obvious benefit of cutting the costs of hiring an internal team, BPO accounting & BPO financial services providers offer flexibility and scalability that fit the varying needs of the business. Outsourced accounting services also include alleviating the operational burden of managing an internal accounting team with the fully managed services model. Furthermore, outsourced accounting providers offer tailored talent-sourcing plans and access to niche-caliber profiles that fit the business needs.

What is outsourced accounts payable and receivable?

Outsourced accounts payable and outsourced accounts receivable mean hiring external AP and AR professionals to handle AP and AR functions. This includes payment processing, invoicing, installment management, vendor and supplier management, order & inventory management, and collections management.

What functions are included in BPO accounting & BPO financial services?

BPO accounting & BPO financial services cover many functions crucial to the business’s performance. Outsourced accounting covers many areas, such as bookkeeping, recording financial transactions, and reporting on them. In contrast, outsourced finance handles financial planning, budgeting, mitigating financial risks, cash flow management, financial analytics, and reporting.

I use 8 years of content excellence experience to ensure everything you read is accurate, backed by real industry data and insights.